CATAWBA BANKING AND FINANCIAL SERVICES CODE GUIDE

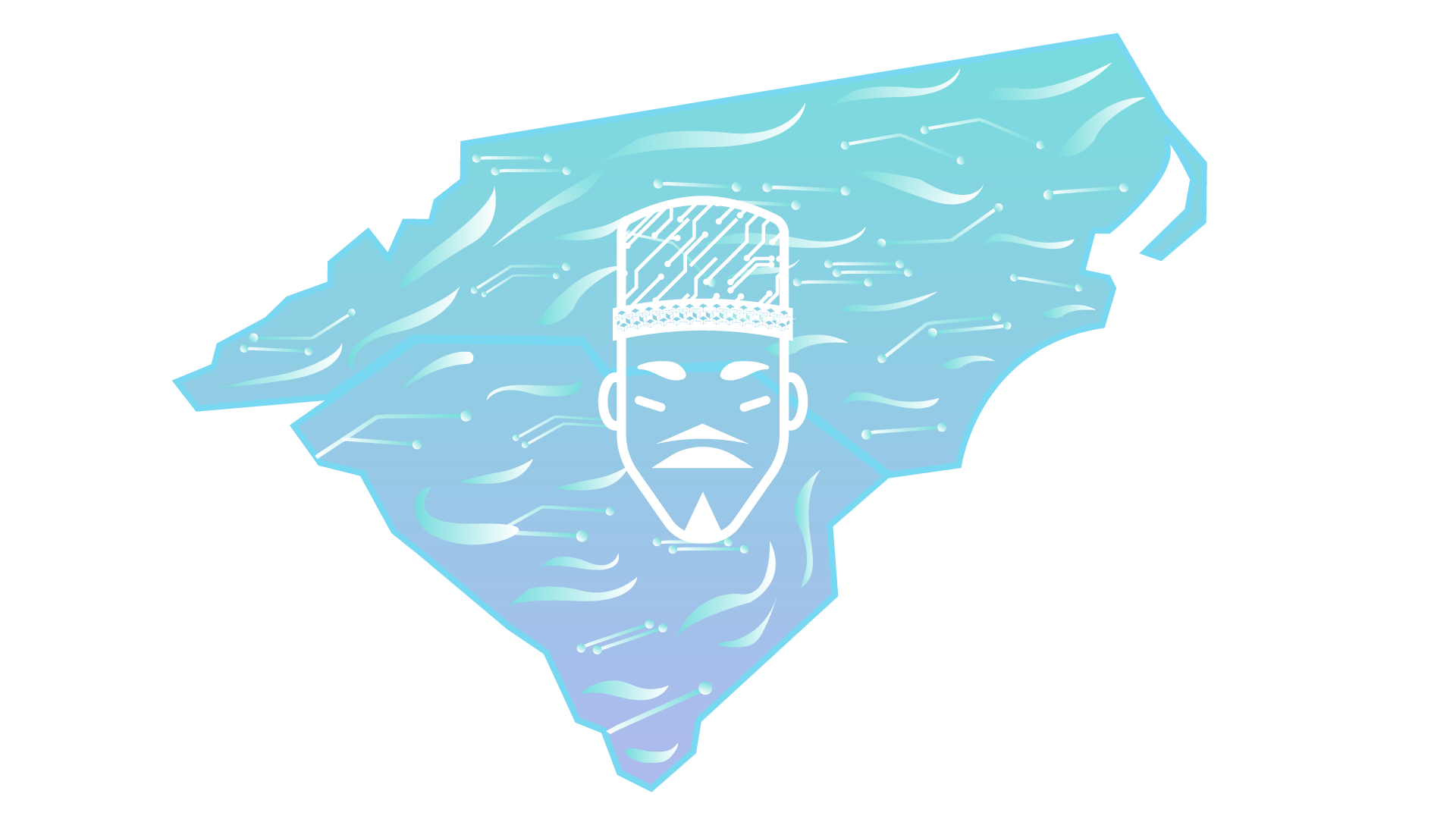

This page describes the Banking and Financial Services Code (the “Code”) of the Catawba Nation and the Catawba Digital Economic Zone (“CDEZ” or “Zone”). It summarizes the content of the Code and approach for implementing a sovereign financial system governed by the Nation’s laws and CDEZ regulations.

The Code compiles the best elements of specific US banking regulations and creates a comprehensive and effective set of laws that provide the Catawba Nation and the CDEZ with:

The Code Contains

For traditional and emerging digital financial activities.

That are already recognized and accepted by the federal government for access to the U.S. and global financial systems.

That enhance the Nation’s sovereignty and create competitive advantages for the Zone’s and the Nation’s economic development.

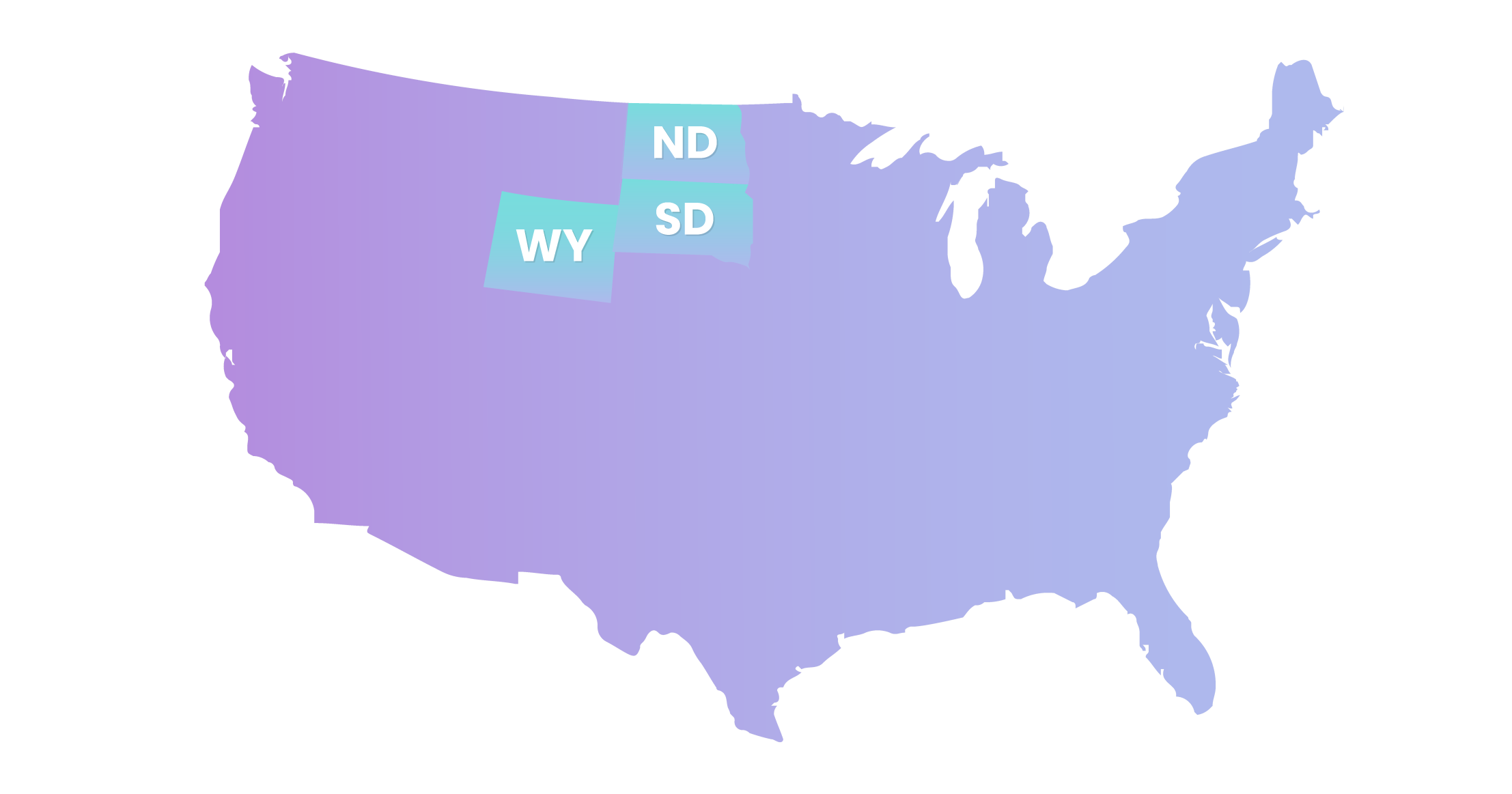

Our Banking Regulation is based on other US state’s banking frameworks:

These state codes were selected as a starting point based on their favorable terms for attracting and efficiently regulating financial activity.

The Code synthesizes terms from the existing financial codes of three states:

Our Banking Regulation is based on

South Dakota’s banking regulation has been adapted as the base text for regulation of traditional banking activities, as this code has proven effective in attracting global banks to domicile in that jurisdiction.

North Dakota is the only state that has established a Public Bank to direct capital for public purposes, and the state’s related code provisions have been adapted as base terms for the Public Bank of The Catawba Nation to facilitate access to capital for its citizens.

Wyoming is the first state to adopt specific regulations geared toward facilitating digital commerce, and the state’s codes for Special Purpose Depository Institutions have been adapted for the Nation’s Code provisions related to regulating digital commerce and assets.

Why is our Code based on other States?

- By starting from these state codes, the Nation is adapting a structure and terminology familiar to and accepted as legitimate by the federal government.

- To enhance the efficiency and attractiveness of conducting financial activity within the Nation’s jurisdiction, consistent with the United States’ laws and oversight requirements.

How is our Code different from the ones of these 3 states?

Some of the original state code sections unnecessarily regulate banking business choices. An example was South Dakota’s requirement that the election of bank officers always occur in the month of January. We have eliminated this and similar unnecessary provisions that intrude with bank’s operations.

The Code also includes sections not found in those state codes, designed to strengthen the legal compliance and commercial integrity of the Nation’s financial system (Chapter 20) and provide for the regulation and management of current and emerging digital assets (Chapter 190).

The Public Bank of the Catawba Nation (ND).

- The Banking Regulation authorizes the creation of a unique Tribal financial institution that will be only the third Public Bank in the U.S.– the others being the Federal Reserve and the Public Bank of North Dakota.

- The Public Bank of The Catawba Nation is designed to be an institution of the Nation’s government, managed by the Banking Commission and issuing charters to private financial enterprises authorized to conduct business within the Nation’s jurisdiction.

- The Public Bank is also intended to enhance access to capital and economic opportunities for the Nation’s citizens, and can offer support for various public-good development activities such as home mortgages, small business financing, and emergency relief programs.

Banking and Financial Services Code Chapters

The Banking Regulation creates the Banking Commission– the primary regulator for the Nation’s self-governed financial system.

- The Banking Commission is the authority in charge of the operations of the Public Bank of The Catawba Nation.

- It is the issuing agency for charters provided to financial enterprises within the Nation’s jurisdiction, and is responsible for enforcing the Nation’s laws regarding financial activity.

- The Banking Commission is appointed by and accountable to the Zone Authority Commission.

(Chapter 30)

The Banking Regulation provides basic requirements applicable to all banks including:

- How are banks formed in the jurisdiction.

- How must bank report changes in structure or personnel to the Banking Commission.

- How must banks actively manage risk to prevent financial loss.

- All banks are required to maintain adequate capital for their operations, in amounts established and approved by the Banking Commission and without future impairment from the bank’s operations.

(Chapter 40)

- The Banking Regulation describes the authorization and restrictions on the types of activities banks may engage in within the Nation’s jurisdiction.

- The authorized activities are broad and consistent with typical code authorizations for the banking industry.

(Chapter 50)

- The Banking Regulation provides regulations for financial enterprises that are engaged in the transmission of money, but are not organized or chartered to operate as banks.

- These enterprises are licensed and regulated by the Banking Commission and are subject to background checks, financial security requirements, and auditing to ensure legal compliance and sound financial practices.

(Chapter 160)

The Banking Regulation sets forth rules and procedures governing the establishment of branch banks and separated banking facilities, to ensure external banks with branches within the Nation’s jurisdiction operate in compliance with the Nation’s laws.

This Chapter also provides authorization for the Banking Commission to work in conjunction with federal, state, and international regulators for reviews and investigations of banks operating in multiple jurisdictions.

(Chapter 80)

- The Banking Regulation authorizes and regulates a new and innovative form of banking: the Special Purpose Depository Institution (SPDI).

- SPDIs are banks that receive deposits and conduct other activity incidental to the business of banking, including:

- Custody.

- Asset servicing.

- Fiduciary asset management.

- SPDIs will likely focus on digital assets, such as virtual currencies, digital securities, and digital consumer assets.

- They may elect to provide custodial services for digital assets and undertake authorized transactions on behalf of customers.

- SPDIs may also conduct activity tailored to digital assets, including technology controls, transaction handling, and custody operations for digital assets.

(Chapter 180)

The Banking Regulation defines:

- The type of loans authorized for banks.

- The limitations on the amount of credit that can be extended relative to a bank’s capital.

- The types of security that banks are authorized to require in exchange for providing loans to customers.

(Chapter 120)

The Banking Regulation governs:

- Permissible bank service company activities.

- Authorization for bank investments in service companies.

- Regulation and examination of bank service companies.

(Chapter 90)

The Banking Regulation defines and governs:

- The handling by banks of funds deposited by customers.

Sets forth procedures for:

- Documenting.

- Administering.

- Transferring deposited funds.

(Chapter 100)

The Banking Regulation adapts the specialized trust company provisions from the South Dakota financial codes, which have been a key factor in attracting new businesses and capital to that jurisdiction (most assets under management by banks of any US state).

The provisions in this chapter have been streamlined to enable the Catawba Nation to offer an even more favorable operating environment for trust businesses.

(Chapter 70)

The Regulation:

- Provides definitions, regulations, and reporting requirements for banks that engage in trust and fiduciary services for customers.

- For example: any bank seeking to engage in trust activities within the Nation’s jurisdiction is required to provide security in a minimum amount of $100,000, to be held by the Nation’s Banking Commission and used to compensate customers in the event of a failure of the bank’s trust obligations.

(Chapter 60)

The Regulation:

- Provides authorization for the leasing of units for the safe storage of bank customer property.

- It includes procedures for joint leasing, corporate leasing, and the disposition of stored property upon abandonment or death.

(Chapter 110)

The Regulation:

- Sets forth the recordkeeping and reporting requirements for banks.

- Establishes the penalties for failing to make proper reports.

- Provides authority for the Banking Commission to take legal action to compel required reporting.

(Chapter 130)

The Regulation provides authorization and procedures for the:

- Purchase.

- Merger.

- Consolidation of existing banks.

- Conversion of existing state or national banks to another form of charter.

The Chapter also gives the Banking Commission authorization to effectuate a takeover or other appropriate action for banks that are engaged in unsound practices or have put the funds of depositors at risk.

(Chapter 140)

- Provides authority and procedures for the Banking Commission to suspend and take operational control over banks chartered under this Title.

- Identifies the requirements and process for liquidating banks that become insolvent.

(Chapter 150)

The Banking Regulation adopts the Revised Uniform Fiduciary Access to Digital Assets Act, which has been adopted into law by 47 states and the District of Columbia. The Act:

- Is designed to provide fiduciaries with the authority to access an individual’s digital assets or electronic accounts after death or incapacitation.

- Was developed by the Uniform Law Commission.

The provisions in this Chapter enable a trustee or executor to supervise the disposition of digital assets as well as traditional tangible assets. It also provides a statutory procedure for custodians of digital assets and electronic communications to safely follow to disclose an individual’s digital assets and electronic communications to a fiduciary.

(Chapter 190)

The Banking Regulation provides definitions for terms appearing frequently throughout the Code, along with terms of general applicability regarding the legal responsibilities of banks and other financial enterprises operating within the Nation’s jurisdiction.

(Chapter 10)

The Banking Regulation:

- Includes a newly-developed section that emphasizes the importance of maintaining lawful operations by all financial enterprises operating within the jurisdiction.

- Provides for consistent and coordinated enforcement of Anti-Money Laundering (AML) regulations between the Nation and federal agencies.

Federal officials have repeatedly emphasized the importance of AML provisions for establishing the legitimacy of the Nation’s sovereign financial system, and this Chapter has been specially drafted to codify the Nation’s commitment to financial integrity and partnering with federal agencies to prevent financial crime.

(Chapter 20)